Pay stubs (aka payslips) tell an employee that they’ve been paid for their work.

Many businesses now use paperless payment options like direct deposit to pay employees. Their wages go straight into their bank account. They’re cheaper to do and save time.

Surprisingly, employers are only required to keep accurate pay records for employees. There’s no requirement in federal law for you to provide a pay stub.

But there are reasons you would still need to provide them. And those reasons also benefit you.

Wondering how to make pay stubs? And why? Read on to learn more.

Why Do You Need to Make Your Own Pay Stubs?

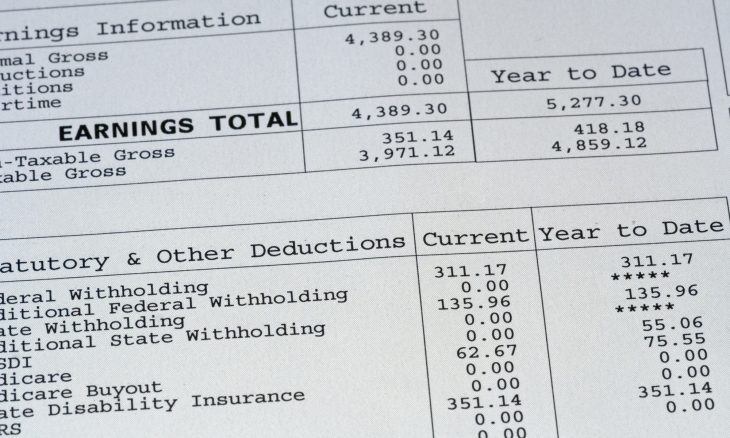

Employees like a record of what’s happening to their money. It shows them the deductions or taxes alongside their pay.

They may need to provide them if they’re trying to buy a house or a car. You may need to make stubs for yourself if you need to prove your income.

It also helps you to improve your record keeping. You’ll get fast access to any payment information you might need, which is handy if an audit rolls around.

Making stubs yourself lets you customize them. Add your company logo or other details as required.

True, a payroll company would create them for you. But hiring one may not be in your budget. So it falls to you to make them.

How Would You Create Your Own Pay Stub?

You could hand write one, but who has the time? Besides, employees want official documents. And few banks will accept handwritten pay stubs.

You can use templates in MS Word or Excel. The advantage of using Excel is that you can run formulas to work out the calculations for you.

Many accountancy programs can help you make a pay stub. Whichever template you choose needs to be compatible with your accountancy software. That means it will add all the information your employees need to their pay stub.

Or you can opt for one of the many pay stub creator websites, like The PayStubs. They provide templates so you can make all the stubs you need.

How to Make Pay Stubs Online

Using an online creator is easy. Fill in the details, such as the employee name and social security number, add the hours worked, and include the employee salary. The stub will calculate the details for you.

Customize the stub as necessary. Then hit ‘create’, and the creator does the rest.

Pay for the stubs and download them. You can even choose if you want separate PDFs or a single file.

Summing Up

Now you know how to make pay stubs for your employees. Choose the method that works best for your business—software or online templates.

Customize them according to the information your employees need. Send them to your staff. Then file copies of the stubs among your records.

Using a creator is cheaper than hiring a payroll company, and it’s often faster than using Excel.

Be sure to head back to our blog for the latest tips and advice for small businesses.