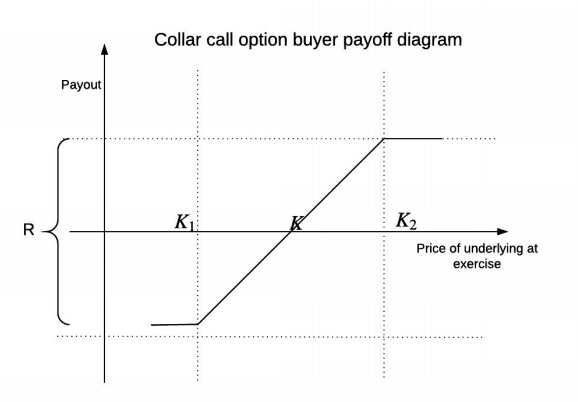

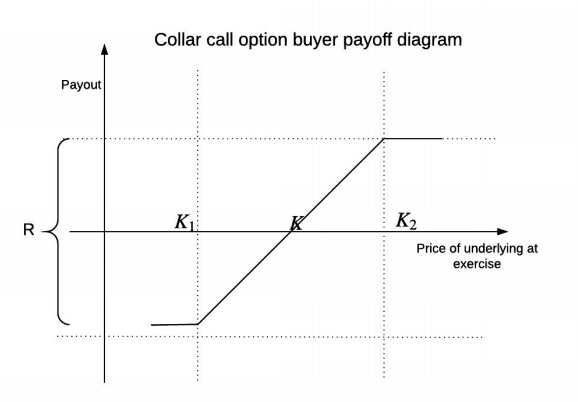

Today you will learn about the costless collar option strategy, which allows you to hedge certain risks on the stock market. Schematically, Collar is shown in the figure below. Continue reading this article, you will about the basic strategies with options: Zero Cost Collar.

Strategic principle

Let us look at the general principle of this strategy and the reasoning of the investor (trader) who applies it.

This strategy is suitable for you if you own shares and are willing to sell them at a strike price of your choice (point “K2” in the above figure). You expect the shares to grow, but want to have insurance in case your expectations are not confirmed.

Therefore, you sell a Call option with strike “B” (separate strategy – “lease shares”) and buy a Put option with strike “K1” (separate strategy – “stock insurance”) – both with the same expiry date.

Risk and profit: Costless collars

Your profits and losses are limited to option strikes.

You will not be able to sell your stock more expensive than strike B, as you provide them with an option if it is exercised.

And you will not be able to lose more on shares than Strike Put option allows. This is how you can hedge your risk with options on the stock market and other assets.

When to use?

It is useful to use the strategy when you:

– buy shares,

– saw their growth and want to fix the profit,

– and you want to take part in a possible continuation of stock growth.

The special feature of the strategy is that you can sell a Call that fully covers the cost of Put, and even get a small profit from the difference in bonuses.

A real strategy example

Let’s take the CVS campaign: let’s imagine that we bought 100 shares at $67 per share, and at the moment the shares are worth $68.89.

Instead of just selling the shares at the current price and fixing a profit of $1.89 per share, we can implement the zero cost collar strategy:

We expect further stock growth and are ready to sell our shares at $70.

So we sell a Call with a strike of 70$ and get 1.46$ per share (146$ per contract). On the trading platform, Interactive Brokers record of this contract will look like this: CVS JUL 20’18 70 CALL.

To ensure our position against losses, we also buy the Put option with strike 67.5$ with a premium of 1.41$ (141$) – CVS JUL 20’18 67.5 PUT.

Thus, the sold Call completely overrides our “insurance” costs – buying Put (146$ – 141$=5$).

Now let’s consider different options at the time of the expiry of our options.

Option 1: the price is below strike “K1”.

After 36 days, the share price does not rise at the time of expiry, but falls below $67.5. In this case we will sell our protective Putt.

Putt does not let us suffer any losses from the stock ownership, because we bought it for $67.5, and Putt allows us to sell our 100 shares for $67.5.

The outcome of the strategy: 67.5 – 67 = + 0.5$ earnings per share or 50$ per contract plus 5$ left over from the difference between Call sold and Putt bought.

Net result: +55$.

With this development, we have earned less than if we had just sold the shares, but this is the price for the chance to take more profit.

Option 2: price above strike “K2”

At the time of exposure, the share price rises above strike 70 and our shares are withdrawn.

Our profit: 70-67 = 3$ per share (300$) plus 5$ “saved” from Call’s premium.

Maximum possible profit in this situation: 305$.

Option 3: the price between “K1” and “K2”

At the time of expiry the price remains at $68.9 or remains in the strike range of $67.5-70, not reaching any of them.

In this case both the sold Call and bought Put will expire depreciated and our profit will be equal: $67 minus the current share price at the time of expiry plus $5 from the sale of Call.

So, we have figured out today how to hedge option risks using the Collar strategy.

I am an Author and what makes me the one is my ability of playing with the words. I also enjoy writing poetry and engaging my audience in my words. I have written for many websites and eBook and gained a good response.