What is gross income?

As we know about the fiscal year, the gross income is the whole revenue around the year. Notably, gross income calculation is average. At first, authorities take payment for the entire year. Then minus the expenses from that. After that, the remaining amount is gross income. You can know what the difference is between gross income vs. net income.

https://www.youtube.com/watch?v=1IXAt33nz0A

We know there are many additional expenses in the whole year. But, gross income does not include all those. Also, the awful income calculation system may vary. Cause every business calculation way is not the same. For calculating gross income:

Gross income = revenue – the cost of the product

For example, if one is an independent contractor, his/her income for the whole year will be gross income. Besides, gross income will be what he earned and multiplying by 12 months. As we already know, gross income doesn’t deduct additional expenses.

What is net income?

Firstly, Net income is the actual income that you get from business or your salary. In sort, net income is the amount of money left after all additional expenses and taxes. Although, if the amount of net income is positive, then you are on profit. Otherwise, if it is minus, then you are on the loss side.

For calculation, very first, you have to know your gross income. Without gross income, it is not possible to calculate net income. After taking gross income, then minus all the taxes, expenses, loans, etc. At last, the excess amount is your net income. Finally, for calculating net income:

Net income = Total revenue- total expenses.

For example, think about Mr. x. His gross income is 20000$. The whole amount is not his net income. Mr. x has loans of 2000$, tax of 1500$, a rental fee of 500$etc. So, now, after all, deduction, the left amount is 16000$. Finally, this is his net income. That is the way of calculating net income.

What is the relation between taxable income and gross income?

When one fills out the tax form, he has to start with his gross income. After that, how much one owns that deducted from the report. Also, few income sources and few types of income are not available in the income tax report.

Also, gross income is not the same as taxable income. Municipal bonds, insurance policies, social security, etc., are not taxable income. Furthermore, they are on the gross income list but not on the taxable income. Alternatively, Agi is another name of taxable income.

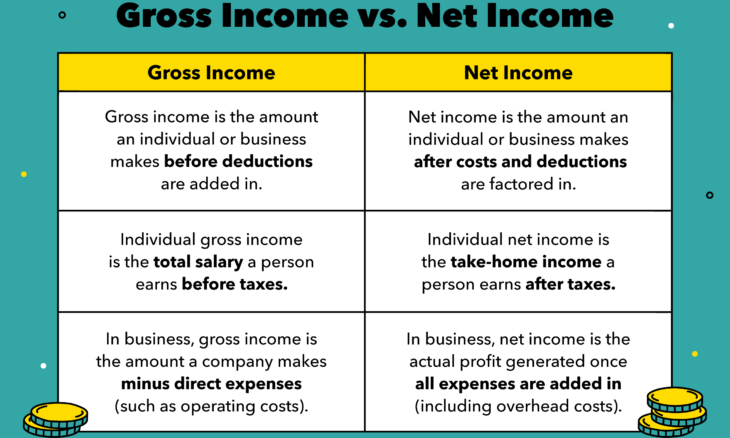

Gross income vs net income

From the above discussion, we know that gross income is a sum of all profit. Besides, net income is what profit remains after all deductions. As we know about the fiscal year, the gross income is the whole revenue around the year. Notably, gross income calculation is average. At first, authorities take payment for the entire year. Then minus the expenses from that. After that, the remaining amount is gross income.

Moreover, net income is the actual income that you get from business or your salary. In sort, net income is the amount of money left after all additional expenses and taxes. Although, if the amount of net income is positive, then you are on profit. Otherwise, if it is minus, then you are on the loss side. Net income is what you take home from the paycheck. This is the way of calculating net income:

Net income = Total revenue- total expenses

As a result of understanding, both will be able to know how much he is saving. He is either on the losing side or profit side, whether it will be wise to start saving money after knowing gross income vs net income.

From gross income vs net income, it will be very helpful to business. Like one is easily able to see or track about his business in the year or year out. Moreover, they can also track which sector has more expenses. Thus, they can cut off those expenses.

Also, a company takes only revenue for gross income. Whether net income is different. For this, they must keep in mind:

- Payroll costs

- Taxes

- Utilities

- Deductions

- Business operation costs

These are the gross income vs net income main differences.

Gross income for business

However, gross income is very helpful to businesses. Like one is easily able to see or track about his business in the year or year out. Moreover, they can also track which sector has more expenses. Thus they can cut off those expenses.

As we already know that gross income is the sum of all profit. Although we know about the fiscal year, the gross income is the whole revenue around the year. Notably, gross income calculation is normal. At first, authorities take revenue for the whole year. Then minus the expenses from that. After that, the remaining amount is gross income.

For calculating gross business income at first, one has to add all the sales without any subtraction. After that, normally subtract all the costs. Then the remaining amount is gross income. In one line it can describe it is:

Gross income = revenue – the cost of the product

This way, people calculate the gross business income.

Gross income for individuals

For individuals, it is much easier. We already know about the rule of calculating gross income. Which is;

Gross income = Full revenue – the cost of the product.

Although, One doesn’t earn from a single way. Whether you may have rental property, business, job, pension, or saving, surprisingly, All of those are gross income elements. For calculating net income, gross income is important. Above all, One has to understand the difference between gross income vs net income.

Understanding the difference between gross income and net income

Till now, we have seen many differences. Gross income and net income are different but also have no difference.

Also, net income depends on gross income. For example, you have a business. That is what you must see its progress if it is going on loss or making a profit. For this reason, you need instant calculation. Here, gross income will help you. You just have to take the number of sales minus the expenses. Finally, the left amount is your gross income. Truthfully, gross income will help you for a quick look, instant decision-making.

On the other hand, net income is way more similar. But this time, you have to take the gross income minus the expenses. Like in one business, there are many expenses, rent, tax, others, etc. By cutting all those, what is left is your net income. This is the actual amount that you get. If your net income is on the plus side, you are making a profit, but if it is not, you are making a loss.

Apart from all, if anyone knows what net income and gross income are. They must have to read gross income vs net income.

Gross income and net income impact on taxes and investment

Gross income and net income have an impact on taxes and investments. You will be surprised to know that. That is why one must make his decision before making a tax sheet. Also, at very first you have to deduct all the expenses. Also, many costs will not apply to making sheets; one must know that.

Eventually, one must have to know the key differences between gross income vs net income. To clarify, one may want to invest in a property or something. For this, they have to know about their net and gross income. Investing in other assets may be good rather than this.

Finally, making a business plan and other investments makes a budget and investment plan much more important above all. Also, one has to research the market how it will impact the wallet. After taking all gross and net income, considering one must make any financial decision.

Gross income and net income impact on a budget

Gross income and net income have an impact on the budget. One will be surprised by knowing that. Since we already know that net income takes away home money. On the other hand, gross income is the money you get as your salary or your business’s full profit. That’s why while making a budget, one must have to consider gross income and net income. Otherwise, one can never make an efficient budget plan.

For creating a budget, small transactions are very important. Because there are many monthly and yearly subscriptions, if one doesn’t consider it, it can greatly impact your investments in the long term.

FAQ:

How is gross income calculated?

As we know about the fiscal year, the gross income is the whole revenue around the year. In one line it can describe it is:

Gross income = revenue – the cost of the product

How is net income calculated?

Firstly. Net income is the actual income that you get from business or your salary. In sort, net income is the amount of money left after all additional expenses and taxes. Although, if the amount of net income is positive, then you are on profit. Otherwise, if it is minus, then you are on the loss side. Finally, for calculating net income:

Net income = Total revenue- total expenses

Is gross income important?

Yes, gross income has its importance. Like if anyone wants to take an imminent decision for his business or his investments. For this, he doesn’t have to consider all. Just calculate the gross income. Just to know if it is worth him or not.

Above all, without gross income, one cannot calculate net income. So it is equally important as net income.

What are the key factors of gross income and net income?

A company doesn’t take only gross income. Because net income is different. Also, the net income calculator is deep. For net income, the key factors are:

- Payroll costs

- Taxes

- Utilities

- Deductions

- Business operation costs

Does Gross income and net income have an impact on a budget?

Gross income and net income have an impact on the budget. It is a surprising one. Since we already know that net income takes away home money. On the other hand, gross income is the money you get as your salary or the full profit from your business. That’s why while making a budget, one must have to consider gross income and net income.

Does Gross income and net income have an impact on taxes and investment?

Gross income and net income have an impact on taxes and investments. That is why one must make his decision before making a tax sheet. Also, at very first you have to deduct all the expenses. Also, there are also many costs which will not apply for making sheets one must have to know that.

Conclusion

From the above discussion, we are able to know gross income vs net income differences BY knowing that we will make efficient decisions on long-term and short-term decisions. Also, one will give importance to all of his small investments, taxes, and business.

Finally, one can spend and invest his money efficiently. Apart from all, if anyone knows what is net income and gross income. How they work. How much importance it has on daily life. They must have to read gross income vs net income.